Singapore firms remain optimistic

Despite weakness in the global economy already affecting Singapore’s open economy1, a HSBC global survey finds local businesses retain a broadly optimistic trade outlook, citing productivity and technological enhancements as avenues for competitive delta. However, a skills shortage is seen as a key commercial vulnerability in achieving these aspirations.

The findings come from HSBC’s ‘Navigator: Made for the Future’, a survey of over 2,500 companies in 14 countries and territories, including the views of the key decision makers in 200 businesses in Singapore.

The Navigator Survey comes as Singapore policymakers put economic growth forecasts under review in light of the global slowdown in manufacturing, trade and investment.2 Yet with the country’s economic fundamentals remaining intact and resilience shining through in the modern services sector3, the survey reveals continued optimism amongst Singapore’s businesses.

Singapore firms optimistic on growth prospects - albeit at slightly more subdued levels compared to their global peers

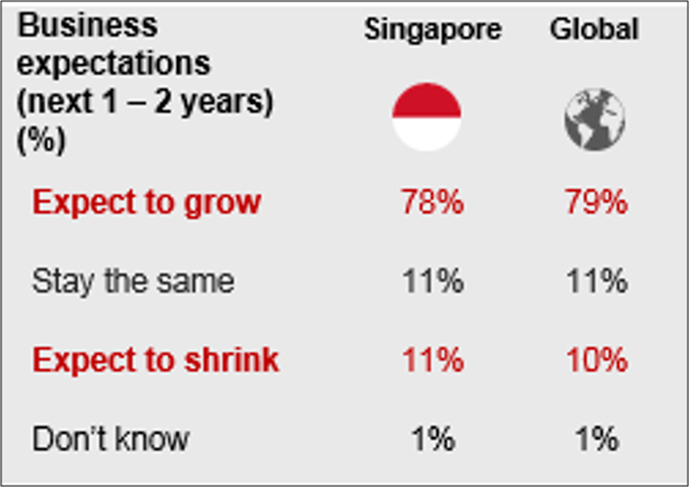

According to the survey, 78% of Singapore firms expect to grow in the next 1-2 years, in line with the global average (79%). Additionally, 35% of Singapore’s businesses say they have become more optimistic about growth in the last 12 months, although this falls behind the global average of 53%.

Singapore’s businesses on the whole (51%) see more opportunities on the horizon in the next 1-2 years, just below the global average (54%).

Yet despite the business optimism, 20% of Singapore firms say they see threats ahead (global average 12%). The top threats for Singapore’s businesses include new competitors (33%), uncertain / declining customer demand, cyber security and protectionism.

Locally based businesses reflect Singapore’s Smart Nation ambitions of productivity and technology as growth drivers of the future

The survey finds that business leaders in the Republic are echoing the priorities set out by Singapore’s Smart Nation4 initiative, with improving productivity (31%) and the adoption of new technologies (29%) as the main opportunities for business growth (compared to global average of 26% respectively for each).

In addition, the survey revealed the importance of innovation to maintaining business continuity, with 44% stating that innovation is a pre-requisite for survival, the second highest level in APAC after China (50%) and above the global average (38%).

Alan Turner, Head of Commercial Banking, HSBC Singapore, said:

“Unquestionably, trade tensions and the shift in expectations of the US Fed on interest rates suggest that we’re near the end of the current economic cycle. As an open and trade-sensitive economy, Singapore will feel this global softness more keenly than other markets. Driving productivity and technological innovation will be the beachhead in Singapore firms’ fight against a subdued domestic and global economic outlook. The path to achieving future growth has been laid out in the Smart Nation initiative, and it is encouraging to see that businesses are showing confidence in the principles to achieve this; placing innovation, technology and productivity and the forefront.

Skills shortages a particular pain point for Singapore

Whilst on board with Singapore’s Smart Nation, Singapore’s firms are calling out for an increase in skills to meet the future challenges underpinning digitalisation of the economy. Singapore businesses identify skills shortage as a key barrier to innovation (36%) compared to the global average (28%), reflecting the second highest percentage amongst markets surveyed.

In addition, Singapore businesses place greater emphasis on people when it comes to future proofing their businesses, with more firms considering investing in the skills of their workforce (26%) compared to the global average (22%), and higher than any other Asia Pacific market. When it comes to the type of skills needed in the Singapore workforce to keep up with the adoption of innovation in businesses, cybersecurity skills rank as the highest (28%), more so than the average across the fourteen markets surveyed (20%).

Mr Turner continued: “The survey also reveals Singapore’s current catch 22: increasing productivity, technology and innovation will overcome competitive threats, but skills shortage and gaps need to be filled. While Singapore continues to grapple with how to better equip its workers to compete in a technologically advancing and increasingly competitive environment, it will be up to the decision makers to allocate investment in their people to ensure their businesses are made for the future.”

The survey comes as recent findings reveal the focus on technology hiring in Singapore. For example about one-third of job roles in Singapore’s financial sector are expected to be “transformed” in the next three to five years as technology takes over a significant portion of job tasks, according to a report by the Institute of Banking and Finance and the Monetary Authority of Singapore (MAS)5. Separately, online hiring in Singapore saw a 16% year-on-year growth in May 2019 according to the Monster Employment Index (MEI), which was dominated by recruitment activity in the IT, telecommunications, business process outsourcing and IT-enabled services industries.6

1 https://www.mas.gov.sg/news/speeches/2019/mds-speech-for-mas-annual-report-2018-2019

3 https://www.mas.gov.sg/news/speeches/2019/mds-speech-for-mas-annual-report-2018-2019